Top molding, mahogany wainscoting, custom built-ins … such is no denying old and historical homes provides appeal we is rarely get in modern-day architecture. If you’ve ever wanted surviving in an attractive old Victorian, a quaint Cape Cod, otherwise an effective stately Georgian colonial, what about studying if that dream might be an actuality?

It’s easy to love the brand new frameworks and attraction away from historical house, and fascinating to take into account the outlook off surviving in one but before and also make you to definitely resource, shop around. You’ll find commonly constraints and additional costs that come with the fresh charm and you will profile of a historical family.

By way of example, residential property which might be appointed historic areas or was registered federally otherwise locally because historic often have really rigorous regulations to have repair and you will remodeling. House that are adjacent to these types of elements, however, aren’t registered, can offer an identical day and age and you will appeal however will not be stored with the very strict (and often expensive) requirements of those appointed because the historic.

In either case, explore how a possible vintage-house buy you are going to change from basic land which have an excellent loanDepot Authorized Lending Manager. Name today for more information.

Insurance could be tough to safe

Insurance policies normally tough as compared to a traditional assets, especially if the home need particular big TLC. If your house you are searching buying is federally joined, bringing covered might be a while much easier. Remember you might have to save money go out than just might think to see a policy to cover property, which will possibly expand your own escrow.

Limits to your variations

Once a house was classified because historic, really exterior transform otherwise position will need to be passed by neighborhood thought payment. This can include anything from color colour so you can replacement window.

With regards to the designation, it is possible to end up being limited by the inside alter you can generate. When you find yourself purchasing the home with the fresh purpose so you’re able to modernize the new cooking area or add an additional bathroom, research your facts. Make sure the changes you are searching and then make are permitted in line with the limits place from the local and you will condition government.

Fix are costly

Just will you be limited with what you might modify, if you want to change particular facts, such as a windows or a door, the choices is limited and you will need to retrofit which have one thing comparable.

In addition, some characteristics will require you to feel a caregiver, for example you’re likely to hire particular providers to simply help repair the appearance of your residence. To simply help counterbalance the prices to steadfastly keep up a historical home, certain says offer provides and taxation loans. Consult your regional town otherwise check out a website such as for example just like the Conservation List to get lists from organizations and you will offers.

Have the home checked by the an expert

If you have moved after dark render phase while having gotten to check, be sure to have fun with someone who are competent to inspect historical homes. Old property usually come with pitfalls you to brand-new residential property don’t have direct decorate, asbestos, if you don’t mold. Which have an individual who understands what they are trying to find will help abate your future can cost you and you may home improvements from the possibly having these materials listed in the contingencies.

When you are a vintage domestic provides you with the initial possibility to alive for the and you can uphold a bit of background, it comes at a cost. Make sure that you happen to be at ease with the repair and you will constraints necessary to live in the house you’re looking to buy.

We’d always help make your think of having a historical household a real possibility! Give our Registered Financing Officials a call today to get more information about the house pick loan that is true to possess your.

- LinkedIn opens from inside the brand new screen LinkedIn

- instagram opens when you look at the https://paydayloanalabama.com/arab/ this new screen instagram

- twitter opens inside the new windows fb

- myspace reveals inside the brand new windows twitter

- YouTube opens up for the the brand new window YouTube

loanDepot Lifetime Verify (“Guarantee”) – Subject to the fresh requirements and contact criteria detail by detail less than, this new Verify relates to the brand new refinancing off a great mortgage started by loanDepot that’s shielded from the same property where one to borrower previously obtained from loanDepot financing and loanDepot Existence Be certain that certification. The newest Verify are non-transferable and will not affect loans gotten to get an excellent this new possessions, the newest funds that make production of another type of lien to your newest possessions (i.elizabeth., a domestic collateral financing), res, and downpayment recommendations software. The latest Make sure along with doesn’t affect money taken out using businesses (elizabeth.g., Credit Tree) or got its start thanks to loanDepot’s General department. New Ensure may only be used by submission an application yourself to help you loanDepot.

For Guarantees issued with the otherwise shortly after , this new Make certain may not be used contained in this 12 schedule days out of the Go out Issued. The ability to receive the newest Make certain to some extent or in whole is at the mercy of future changes in Federal or state legislation, otherwise trader otherwise guarantor constraints on the refinancing the existing loan. loanDepot do not make certain that the borrower would be recognized having an effective upcoming mortgage, the pace for the next mortgage, or the coming appraised worth of our home. The newest borrower’s capability to be eligible for a future loan might be susceptible to the mortgage program terms and conditions offered at you to definitely day. To possess upcoming financing conference the aforementioned standards and you may that are effortlessly finalized, no lender payment might be energized. Lender payment doesn’t come with disregard factors from the financing deal. Small print is susceptible to change with no warning.

Upcoming candidates have to contact loanDepot truly via the site: loandepot/lifetime-verify or via mobile (877) 395-7381(888) 983-3240 to be eligible for brand new Be sure. Trying to get an effective loanDepot mortgage indirectly by way of a 3rd party (elizabeth.g., LendingTree) makes the borrower ineligible because of it Make certain.

Testimonial disclosure – Settlement wasn’t paid in exchange your recommendation with this webpages. Some body envisioned is almost certainly not that brand new endorsers and that is having monitor aim simply.

Re-finance disclosure – By the refinancing the existing mortgage, the entire finance costs are higher along side life of the loan.

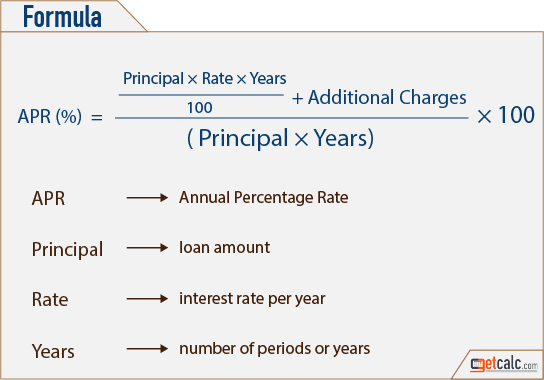

Speed Presumptions – Prices shown are susceptible to changes and you can takes on your to find otherwise refinancing a manager-filled unmarried house, debt-to-income ratios out of thirty-five% or straight down, house and you may put aside standards are satisfied, as well as your assets has that loan-to-property value 80% otherwise faster. New Apr (ount and may are around step three points. (Situations is people origination, discount and financial charges.) With the varying-rate loans, interest rates was subject to prospective develops along side life of the mortgage, since the very first repaired-speed several months expires. Delight get in touch with a Licensed Lending Officers at (888) 983-3240 to possess a customized speed and you will payment price.