Because of the tall home appreciation one to occurred within the 2023, the fresh new Federal Homes Funds Institution (FHFA) provides boosted the compliant loan restriction to possess 2024 for all counties nationwide.

This means that residential property you can in earlier times merely get which have an excellent jumbo mortgage can be eligible for a compliant mortgage – meaning lower rates and less restrictive certification criteria.

In the most common areas, the 2024 limit conforming financing restriction really worth for example-product features is $766,550 – a rise off $40,350 of 2023.

In the high-prices areas (areas where 115 per cent of your own regional average domestic really worth is higher than the fresh new baseline compliant mortgage maximum a lot more than), the newest limit for a compliant home loan could well be $1,149,825 – a rise of $sixty,525 out of 2023.

What exactly is a conforming Mortgage?

Just like the overall economy from 2008, very people are accustomed the fresh new labels Fannie mae and you can Freddie Mac. These two entities try mortgage aggregators that exist under the oversight of your own FHFA. It suffice the objective of to invest in mortgage loans, packaging them for the home loan-supported bonds, and you can attempting to sell those people securities to people.

A conforming financial relates to financing that meets (or вЂconforms’ so you can) Fannie mae or Freddie Mac’s purchase requirements. These requirements account fully for situations such as for example down-payment, earnings, credit rating, and you will https://cashadvanceamerica.net/payday-loans-ak/ debt-to-earnings ratio.

Amount borrowed is another factor, which is where the conforming loan maximum comes into play. Fannie mae and you may Freddie Mac computer does not purchase finance above the conforming mortgage restrict. A property which have a price beyond the compliant loan limitation need to be funded using an excellent jumbo (otherwise вЂnonconforming’) mortgage, which comes which have more strict certification criteria.

NOTE: New terms and conditions вЂconforming’ and you will вЂconventional’ usually are utilized interchangeably, however, there are some distinctions. A traditional mortgage merely makes reference to a home loan that isn’t backed by a federal government institution. In other words, a traditional home loan was any financing that is not given from the brand new Federal Construction Administration (FHA), this new Service off Veterans’ Things (VA), or the United states Agency regarding Farming (USDA).

How can Conforming Loan Restrictions Perception Your?

One of the benefits of conforming funds is they bring competitive rates. Because these fund is actually backed by Federal national mortgage association and you may Freddie Mac computer, lenders much more willing to give all the way down pricing to consumers just who qualify. This may result in extreme savings over the lifetime of the fresh financing.

Yet another advantage of compliant fund is because they normally have even more flexible credit standards. Whenever you are a good credit score continues to be extremely important, individuals that have a slightly down credit history may still qualify for a conforming financing. This is exactly specifically great for earliest-time homebuyers who might not have an intensive credit score.

Like, imagine if your made an effort to pick property inside the Sodium Lake State into the Utah during the 2023. Your must score a mortgage getting $750,000, however, because your amount borrowed is actually higher than the new 2023 compliant mortgage limit regarding $726,two hundred, you’d to try to get a jumbo loan.

Regrettably, you only got 5% secured to possess an advance payment along with your credit history was perhaps not sufficient to help you be eligible for a great 5% off jumbo loan.

In 2024, everything is switching! Conforming loan restrictions could be risen to $766,550, and therefore the house you want can ordered that have a conforming financing. You won’t just be eligible for the loan, however it is more than likely you will delight in a lesser interest than just you might has actually gotten towards jumbo mortgage. You may even manage to decrease your advance payment so you can step 3.5% and you may reallocate that cash to pay off additional debt and you can preserving a lot more money per month.

The conclusion

If you’ve been seeking be eligible for a mortgage but have already been which have particular dilemmas getting a beneficial jumbo loan, it is possible to soon be able to qualify for a conforming financing that have top conditions.

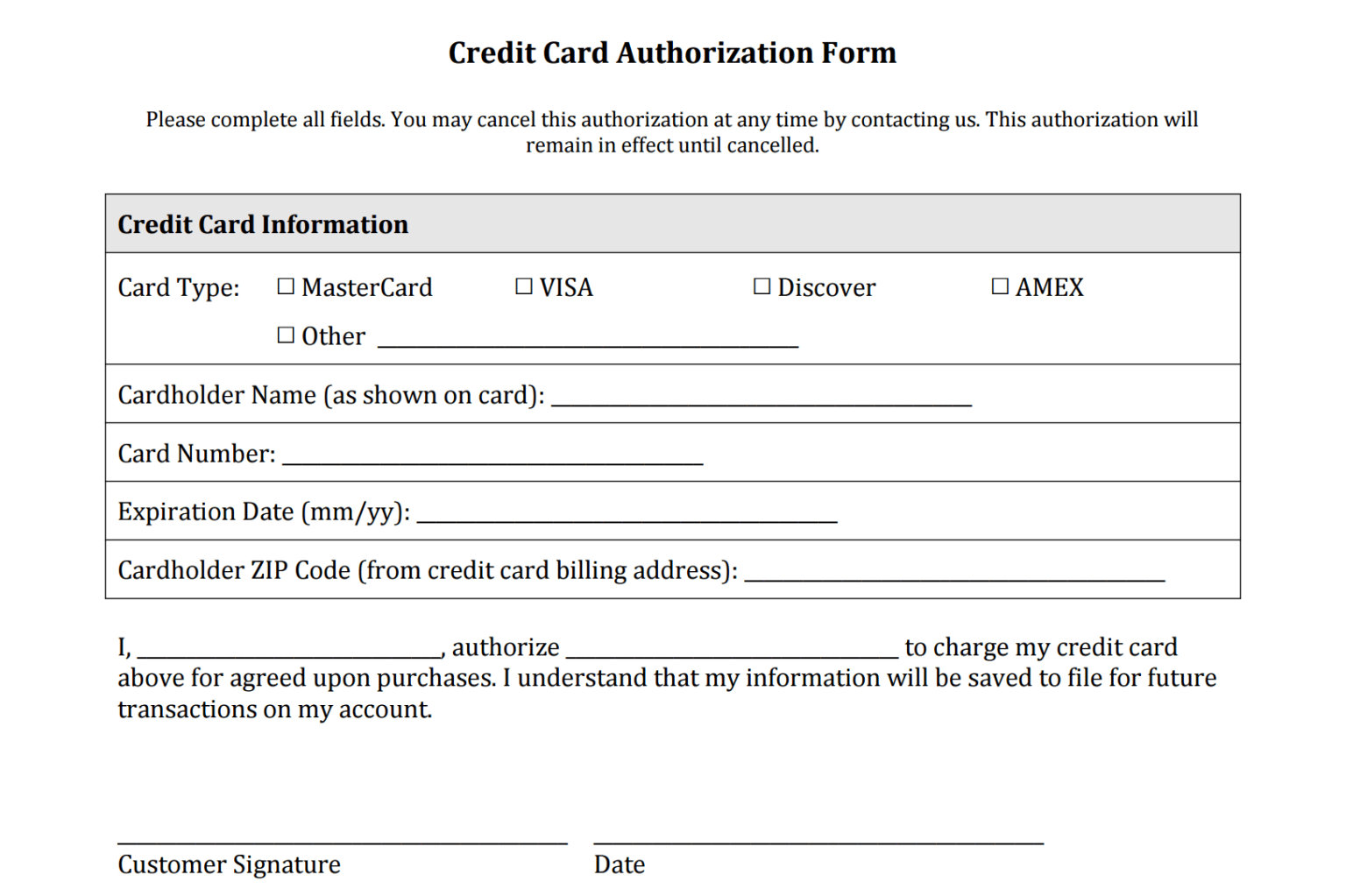

If you find yourself on the market to purchase property, the time has come to begin with the mortgage process so you are ready to buy whenever this type of mortgage constraints changes the coming year. If you have any queries or wants to initiate brand new software processes, submit the proper execution below so you’re able to consult a scheduled appointment having one to of our financial advisers.