The best test with respect to to invest in a house for some People in the us are lack of deposit. We understand rescuing to have an advance payment can seem overwhelming, but in the Treadstone, we offer several loans which have low down fee options, as well as several that have zero down payment installment loan Cleveland! We helps you choose the best system to you personally and then make their hopes for homeownership a reality.

RD (Outlying Invention) Financing, also known as USDA Financing, is booked to own first homes in rural components. Some general criteria having RD Money is:

- Precise location of the assets

- Household earnings and you can house limits

- House should be the buyer’s no. 1 quarters

Va Fund is reserved to have experts and you may effective duty solution participants, given that place of the Agency out-of Veterans Situations. Particular standard conditions to possess Va Loans become:

- Appropriate COE (Certificate out-of Qualification)

- Home should be the consumer’s number 1 household

Just what Michigan Financing Applications Bring Nothing Money Off?

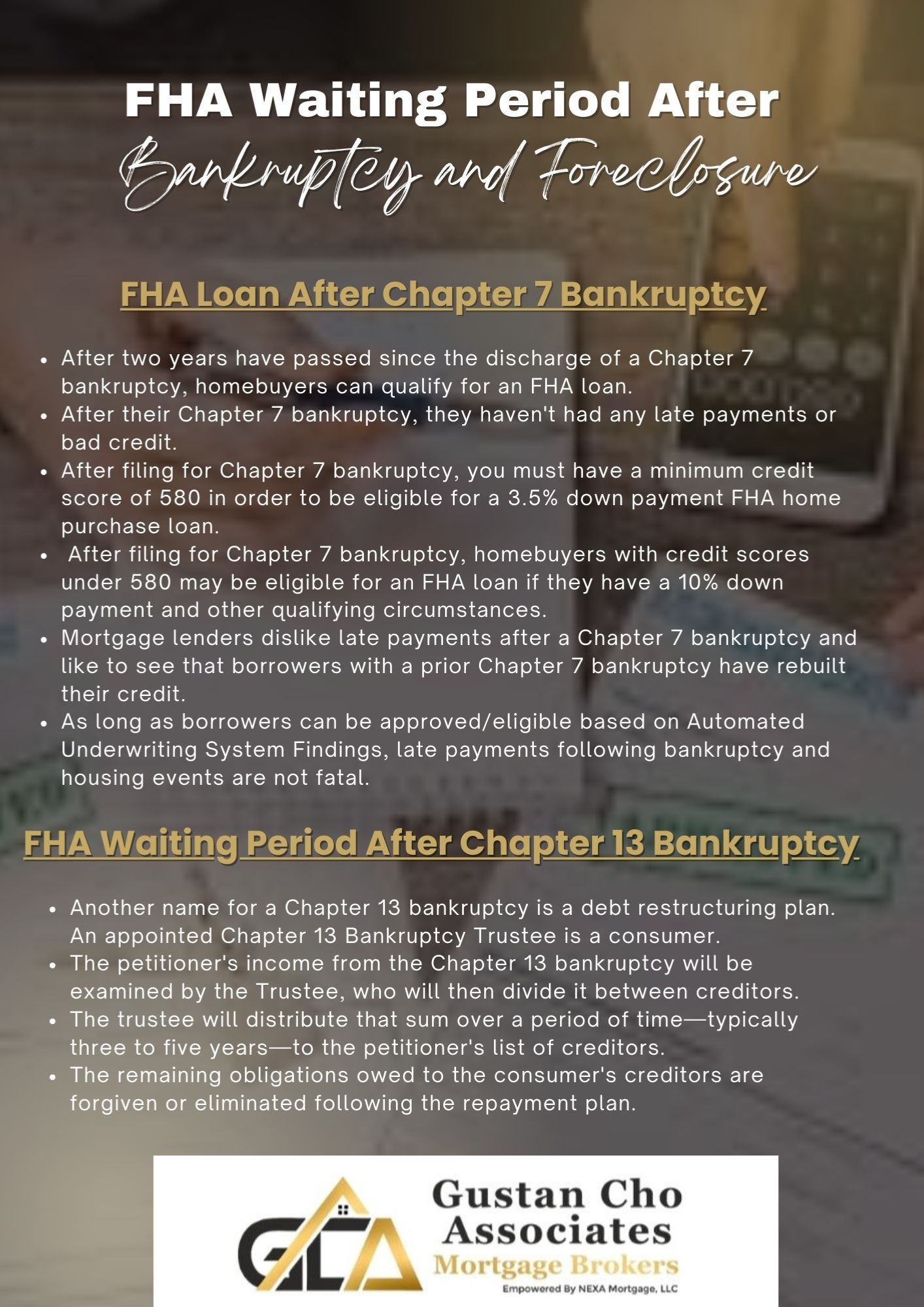

FHA Money is actually supported by the federal government (including each other USDA and you can Va Finance) and are also an excellent alternative having versatile qualification standards. FHA Fund is actually to own number one homes merely and can even become better-suited to individuals with a lesser credit rating and want credit self-reliance.

Conventional Fund are the most commonly known home loan type in Michigan. Traditional Finance also are many flexible sorts of financial, and are also useful in multiple items. To qualify for the lowest downpayment alternative, consumers need to slide from inside the money limit set for the geographical urban area or even be a primary-date house client.

The solution to choosing your down-payment count will be based upon your personal financial predicament! Homebuyers who would like to expedite their house buy find a no down payment option of good use or required.

Their advance payment matter privately impacts multiple regions of the loan- monthly mortgage payment, financial insurance coverage, and you can maximum approved loan amount among others. The Treadstone Mortgage Officer will help decide if a zero down payment financing suits you!

- Preserves more cash from inside the financial small-identity

- Could possibly purchase sooner rather than later

- Have fun with savings to own quick fixes, renovations, otherwise decorating

- Zero-off mortgage loans usually have can have higher interest levels dependent on the borrowed funds system

With regards to the Michigan financing system your be eligible for, minimal advance payment can range from 0% to three.5%. Your loan Manager will allow you to determine suitable program to own you! Before this, check out addiitional information getting very first-time buyers.

What other Info Occur getting Basic-Time Home buyers?

Among the rewards ‘s the Michigan Basic-Big date Customer Checking account. This is a tax-100 % free family savings to own future home owners, such as a keen HSA otherwise 529 training family savings. All money lead to so it lender or broker membership increases and become conserved without any state taxation due for the their harmony otherwise benefits. For more information, read all of our self-help guide to Michigan’s FHSA.

An alternate cheer getting Michigan home buyers are MSHDA, a down-payment guidance system regarding Michigan State Housing Development Expert. Eligible people you can expect to found $ten,000 into the down-payment advice money used having settlement costs, pre-paids, and also the advance payment itself. MSDHA need a-1% minimum down payment in the debtor and that’s the second mortgage in your house with 0% interest. Such funds can be used for the newest advance payment and you may/otherwise closing costs. On the other hand, MSHDA’s deposit assistance is limited into residential property priced under $224,500. To see if your meet the requirements as well as for additional information, contact one of our Michigan Financing Officials!

I wish to establish as little as you are able to; what program is the best for one?

There are financing software that require little to no down repayments. Contact your Loan Officer observe just what system you could be considered for hence fits your needs top. Just remember that , most of the house requests possess closings can cost you and you may prepaid will set you back also the advance payment.

The easy address: it all depends! On Treadstone, you’re more than your credit score, and you will our very own Financing Officials can perhaps work with you in your novel condition.

Choices are minimal, but we like to get innovative. Certain programs may allows you to buy another house or apartment with little money down, however, as each person’s situation is special, there’s no you to-size-fits most of the. Drop united states a line and we’ll carry out all of our best to functions some thing aside!