A routine financial offers income tax professionals eg a good deduction all the way to Rs. step 1.5 lakh on the dominant fees significantly less than point 80C of your Earnings Taxation Work and you may good deduction of up to Rs. 2 lakhs to your appeal repayments within the a monetary season not as much as part 24 of one’s Income tax Work. It is possible to claim a taxation work with if you have taken out a home loan balance transfer. But first, why don’t we determine what a top-up loan is.

Area 80C of one’s Income tax Operate

The greatest allowable deduction is actually Rs. step 1.5 lakhs. The brand new priount ‘s the subject associated with the point, gives tax positives. It supply of Taxation Act lets a single to help you subtract income tax paid to settle the prominent loan amount. So it provision makes you claim deductions to possess amounts paid off on fixed dumps, senior citizen deals agreements, Social Provident Funds (PPF), national protecting certificates, and other authorized deductions. not, note that exceeding the fresh restrict off Rs. 1.5 lakhs disqualifies you from stating any taxation deduction to the exceeding amount. As long as the building is fully gone can get your claim a tax reduction. This condition cannot provide for tax masters getting functions you to definitely will still be around invention.

Very, in case your assessee has already established tax masters in the form of deductions, the house or property can not be directed. Point 80(5) of Tax Work imposes that it supply. Homeowners need waiting at least five years from the stop of one’s assessor’s control season just before going such functions.

Section 24 of Tax Act

The newest tax work with with the interest paid to your a mortgage is available less than this condition. A max deduction regarding Rs. 2 lakhs is available for the debtor. In case your domestic wasn’t ordered to have notice-industry, although not, there’s no limitation restriction. The home have to be complete inside five years; if not, the deduction number was reduced regarding Rs. 2 lakhs in order to Rs. 30,000.

80EE of your Tax Work

First-day homebuyers take advantage of Section 80EE of your Taxation Operate, that enables getting an income tax deduction for the desire https://paydayloancolorado.net/campo/ paid down on a home loan. Having basic-day household loan borrowers just who build attract costs on their home loan, an additional amount of Rs. fifty,000 was acceptance. This even more leverage of Rs. fifty,000 have been in inclusion to your deductions from Rs. 2 lahks significantly less than Area 24 and you may Rs. 1.5 lakh not as much as Section 80C of the Income tax Act, respectively.

Criteria for Saying Tax Work for at the top-Up Home loan:

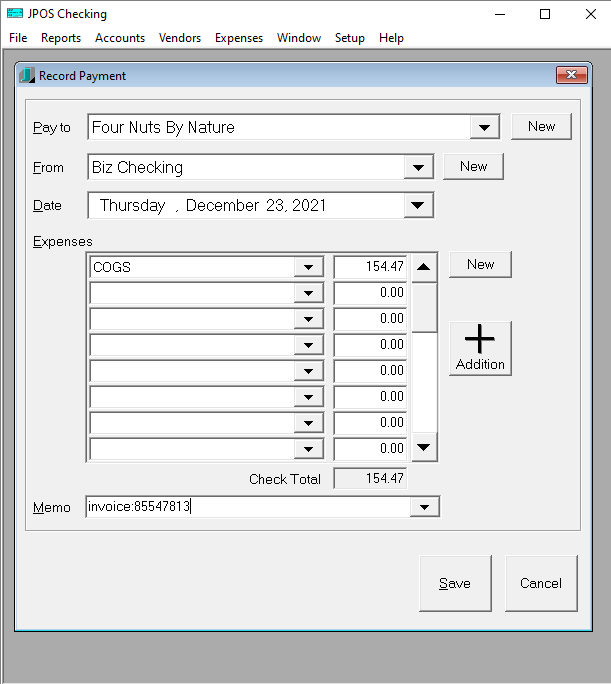

To verify your better-upwards financing was applied into the order, building, renovation, or resolve of the property otherwise home, you’ll want invoices or any other necessary papers. When your financing were utilized for renovation, resolve, otherwise adjustment of your home, zero deduction is reported towards the fundamental money.

2 and you will Don’ts If you find yourself Claiming the newest Deduction

Even although you has actually overlooked the actual fee, you can allege an effective deduction toward desire part of the payment. It is because point 24 cash Tax Operate relates to attract costs on casing loans as paid back otherwise payable. not, store the new records inside a rut however, if taxation authorities require confirmation.

Next, only when the borrowed funds amount is required for solutions, renewals, customizations, or perhaps the purchase/structure out-of property have a tendency to new deduction (often on focus payments/dominant payment or each other) meet the requirements qualified. There won’t be any deduction whether your most readily useful-up loan is used for other things, particularly kids’ training or children travel.

Eventually, suggestions and you may data have to be kept to establish that the loan are taken to resolve or upgrade a house.