Begin by examining current rates of interest and you can relevant will set you back away from certain lenders having fun with on line gadgets and you will comparison platforms. Measure the reputation for prospective lenders of the reading product reviews and seeking suggestions. See the some other home loan sizes and you will terminology to decide and that aligns together with your financial expectations. Consider customer care top quality, responsiveness and you will interaction clarity. View degree criteria and you will consider obtaining prequalification otherwise preapproval out of multiple lenders to own an intensive analysis.

Step 3: Assemble Your financial Files

To obtain preapproved, you will have to render the bank with economic data files to them to review in your app. These include, but they are not limited in order to:

- Proof earnings

- Proof work

- W-2s

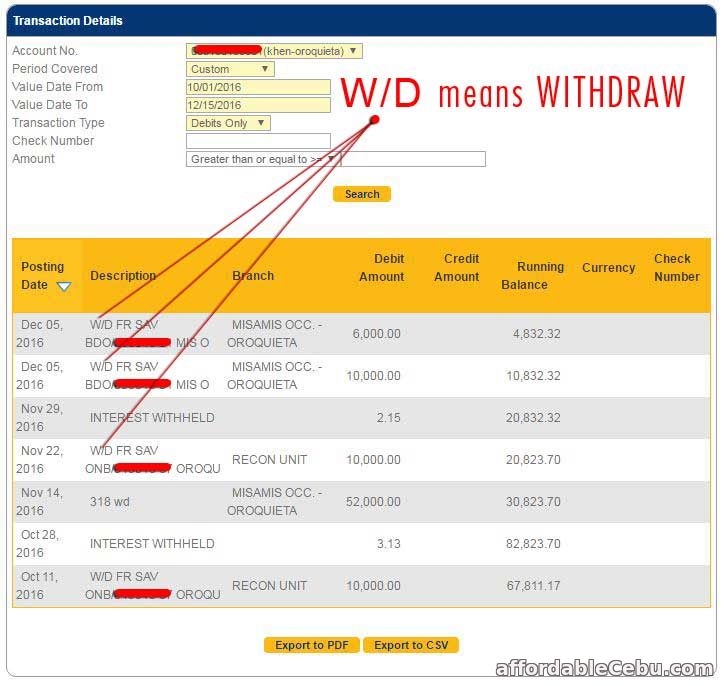

- Financial comments

- Societal Protection matter

- Latest driver’s license

Step four: Ensure you get your Credit Looked

Their bank have a tendency to perform an extensive credit check to assess your credit history. Which comparison assists the financial institution gauge your existing financial obligation, percentage history, in addition to type of costs you have cash advance Fort Collins Colorado handled in the past. An optimistic credit report, appearing timely costs and you will debt prevention, ranking you since a reliable borrower. However, a history of skipped money or non-payments will make lenders a great deal more mindful. After that testing, the lending company decides the newest approved amount borrowed while the related appeal rates, that delivers a very clear comprehension of the reasonable house price. This post is formal during the good preapproval letter, a vital file you could potentially give possible manufacturers in order to emphasize their preparedness and you will dependability since the a great homebuyer.

Action 5: Begin Our home Take a look

Through to getting a home loan preapproval page, your property research becomes a very strategic process. Start by carefully examining the newest letter to determine your recognized mortgage number, providing an obvious plan for your home look. Explain your house goals, provided activities such area, dimensions and you will business. Participate the help of a real estate professional in order to navigate listings effortlessly, incorporate on the internet platforms to own research and you can sit in discover homes so you can aesthetically assess prospective belongings. Remain arranged on your studies, scheduling private viewings to own guaranteeing properties. Envision upcoming growth and extra will set you back, continuously examining and you may reassessing your own goals to ensure a working and advised method to your residence search. The fresh new preapproval letter functions as a robust tool, allowing you to confidently speak about homes in your economic details.

Strategies for Preapprovals Getting Mortgages

From the pursuing the bulleted number, we outline important procedures and you can factors to compliment debt profile and you may navigate new preapproval procedure with confidence:

- Thought to purchase a house under your preapproved amount borrowed: Even though you’re acknowledged having a certain amount does not mean you should borrow that much. Deciding to buy a house using your preapproval number also provides several advantages. It offers economic independency, letting you deal with unforeseen costs or changes on your economic situations significantly more easily. More over, purchasing below your preapproval limitation may cause more affordable month-to-month mortgage payments, leading to a very green finances. This approach together with allows for self-reliance when you look at the pursuing other economic wants otherwise assets later.

- Never make any big commands immediately after you’re preapproved: To make big instructions prior to reaching the closing desk is pose extreme dangers to your residence to acquire process. High expenses will get feeling the debt-to-earnings ratio, possibly affecting your eligibility and you can loan conditions. It may and additionally improve worries about loan providers concerning your economic stability, leading to an excellent reassessment of one’s loan application. To ensure a mellow latest acceptance, you may want to cease big sales that may improve your monetary profile until pursuing the financial could have been secured.

- Make your credit rating prior to getting preapproved: Strengthening borrowing before seeking to preapproval getting a mortgage also offers multiple trick experts. First and foremost, a higher credit history commonly contributes to a great deal more positive loan terminology, together with straight down rates. As well, a robust credit score advances your current monetary reputation, instilling believe into the lenders and potentially enhancing the odds of preapproval. Finally, a solid borrowing foundation can be increase your own directory of home loan solutions, that gives greater flexibility and you can probably helping you save currency more the life of your financing.