An effective Michigan Old-fashioned Home loan is actually a vintage home loan mortgage getting perfect borrowers. For those who have prime borrowing or close prime borrowing this may be the ideal type of financing for you.

If you’re less than 80% LTV (Loan so you can Really worth) you’ll be able to quit PMI (Individual Mortgage Insurance coverage or Mortgage Insurance fees). Conventional Mortgage loans also are best for homebuyers which might be in a position to lead an effective 20% down-payment (yet not the majority of people choose a lowered down-payment).

Name Today to get going!

By the clicking “Submit”, you accept found calls and you can messages at amount your considering, also profit by autodialer and you will prerecorded and you will artificial sound, and you may email, away from Riverbank Fund LLC concerning your inquiry or other house-relevant things, yet not since a disorder of any pick; that it enforce it doesn’t matter if you look at, or leave united nations-checked, one container significantly more than. You also invest in our very own Privacy policy and you may Terms of service concerning your guidance based on your. Msg/research costs can get incorporate. So it agree applies even if you are on a corporate, condition or national Dont Name record. Which zero obligations query will not make up a home loan application. To use now or rating instant direction, call us at the step one-800-555-2098.

Because of the meaning, a conventional Real estate loan is any home loan that is not protected otherwise insured because of the national. Generally speaking a conventional financial are a home loan you to definitely adjusts to help you the factors lay of the Federal national mortgage association and Freddie Mac.

Mortgage brokers instance a normal mortgage shall be in love with the supplementary industry once the a home loan backed cover (MBS) since they’re in identical style while the other mortgage loans. Non-compliant fund try funds that do not meet with the standards set of the Fannie mae and you can Freddie Mac computer and tend to be kept while the a profile mortgage rather than resold.

Traditional Home loan Calculator

Interested in learning exactly what your money could be for folks who used an effective Antique Loan to order a personal loans Colorado property? Use the Conventional Home loan Calculator so you can imagine complete monthly premiums. Rather than, almost every other on the internet conventional loan hand calculators, ours inclues dominating, notice, taxes, insurance rates and PMI rates to convey an authentic estimated payment.

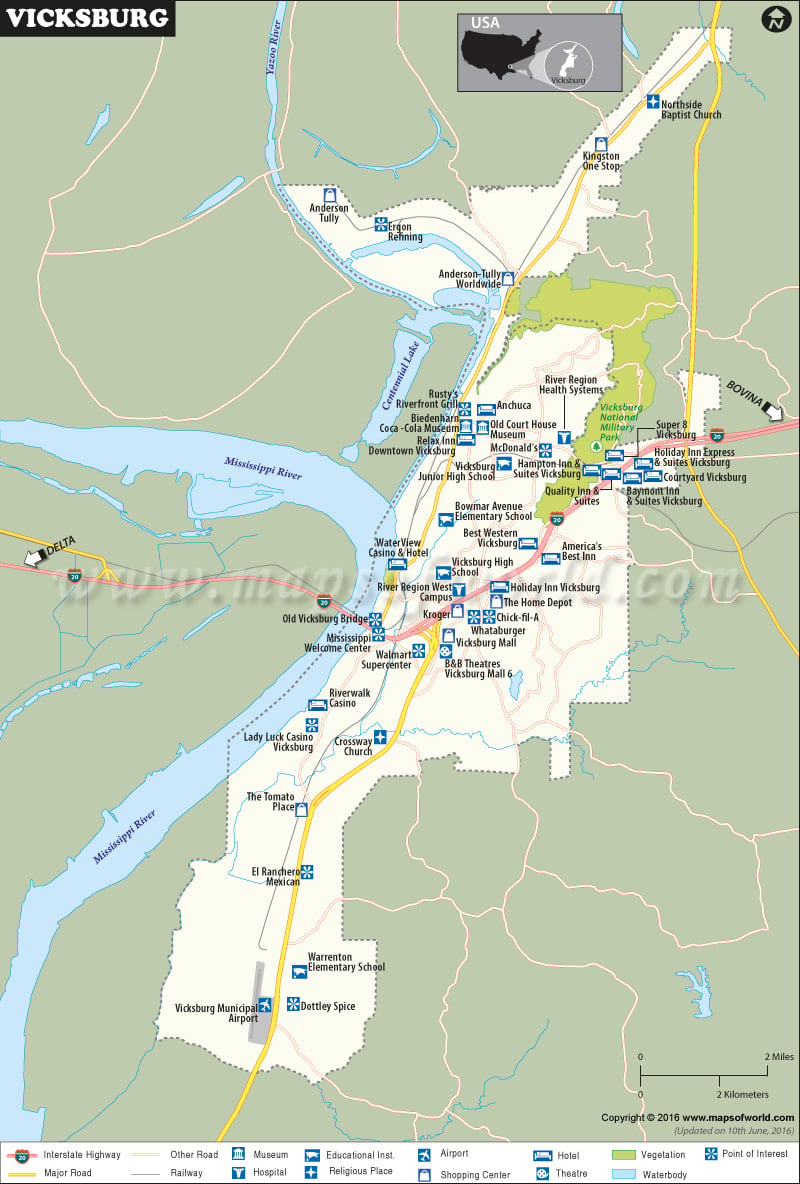

The most amount borrowed getting Conventional Compliant Loan varies from county to condition and you will out of one state to another. The best limit Conventional Home loan limit correct is set from the $970,800 in the cities instance Alaska and you may The state but they are thought high will cost you components.

The average restriction Conventional Financial number found in one condition is $715,000. More resources for conventional financing constraints go to Fannie Mae’s Loan Limitation graph: Conventional Loan Restrictions. In case the mortgage is above $715,000 it could well be experienced a great Jumbo Financing.

Multi-unit homes possess big conventional loan limitations

- 1-product features: 2024 Traditional loan limitation of $766,550

- 2-equipment properties: 2024 Antique loan limitation from $981,five hundred

- 3-device features: 2024 Conventional loan limit out-of $step 1,186,350

- 4-tool functions: 2024 Traditional mortgage restriction regarding $1,474,eight hundred

Michigan Old-fashioned Loan Constraints

Michigan does not have any higher pricing portion so that the old-fashioned loan restriction is determined on $766,550 for everyone counties. The next link has actually a complete selection of 2024 Traditional Financing Constraints.

A traditional mortgage down payment requisite is typically between step 3% and you will 20% of the cost. The high quality at most mortgage enterprises try 5% of price toward downpayment criteria but not it matter can vary away from bank to help you bank.

At Riverbank Funds, we support as low as good step three% downpayment on the a traditional home loan to save money in your pouch. The brand new Freddie Mac Domestic You’ll be able to Financial may be a great fit for very first time home buyers with little to no reserves. Of several traditional home loan apps have the best interest levels having 5% down. Many homebuyers favor a great 20% downpayment to own a traditional financial to end PMI.