The Government Homes Government get right back the brand new funds out-of accredited individuals having credit ratings only five hundred. That it versatile loan system usually allows homeowners to put off ten per cent, and you will a 50 percent obligations-to-money ratio are acceptable. Lenders will get hold the discretion to provide FHA financing which have all the way down down money for consumers which have a credit history out-of 580 or large.

Va Loan Credit history Criteria

The U.S. Service from Pros Affairs does not always require a certain credit get to help you right back this new mortgage loans from qualified army professionals, experts, or surviving partners. However, loan providers basically require a credit score away from 580 so you’re able to 660 so you can agree Virtual assistant fund.

FICO Score Versus. Credit score: What is the Variation?

The newest terms FICO Get and you will credit score try mainly similar. Certain distress really does persist certainly one of consumers just who pick three various other numbers was allotted to all of them.

The fresh FICO rating system was made because of the engineer Bill Fair and you may mathematician Earl Isaac inside 1956. Its name is essentially an abbreviation to your Reasonable, Isaac, and you can Business. The people marketed the newest liberties, therefore ultimately emerged since the a standard program familiar with assign an excellent three-fist matter so you’re able to consumers. A beneficial FICO rating stands for an impartial research regarding another person’s creditworthiness founded towards metrics associated with fees background payday loan El Moro, borrowing application, age account, although some.

Brand new institution off significant credit bureaus – Equifax, Experian, and you will TransUnion – contributed to anyone acquiring about three additional wide variety, or credit ratings. Regardless of if for each and every borrowing from the bank company angles its get towards FICO prices, the information and knowledge they normally use may differ.

Loan providers aren’t always bound by one otherwise all of the Credit scores. Some lenders, like your local respected borrowing connection, have a whole lot more versatile standards. Certain lenders get favor one bureau over the other or consider the three ratings holistically. Whenever you are your credit rating offers significant weight inside securing a mortgage, additional factors are also powerful. not, higher credit ratings always discover possibilities for all the way down interest rates and one particular positive home loan words.

How to Improve Credit score Prior to purchasing property

Potential housebuyers are usually stunned during the just how easily they can increase a credit rating. Once you understand how FICO rating system features, simple alterations to your financial profile increases the three-fist count. And therefore credit score upgrade causes several thousand dollars in the offers over the life of a mortgage. Talking about methods that will improve your credit score.

- Consult a free of charge Content of Credit file

- Check the Credit history to possess Errors

- Request Errors come-off

- Pay-off Credit debt

- Pay Your own Costs timely

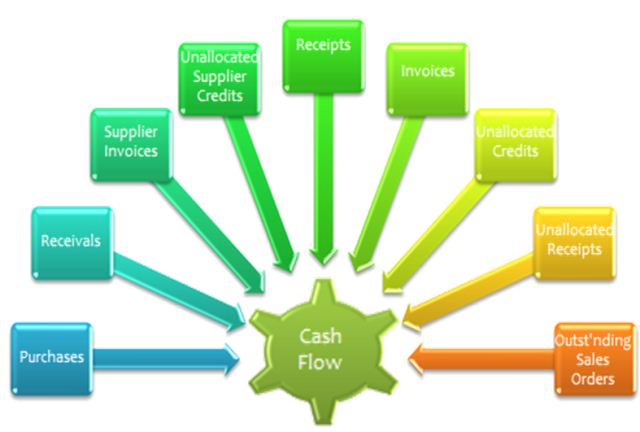

Also cleaning problems and you will paying down credit cards, believe focusing on enhancing your loans-to-income proportion. Along with a strong credit history, lenders consider how big home financing percentage community professionals can also be realistically manage. Some of the promising mortgage programs introduce obligations-to-money thresholds for it very cause.

Before you apply to have home loan pre-acceptance, tally up your current loans and you may smartly pay accounts down. Eg, make sure your offered credit line account are below 50 per cent. A minimal personal debt-to-earnings ratio, coupled with a far better credit rating, assists individuals obtain financial acceptance with the lower you are able to financial appeal rates and common terminology.

If you’re considering buying your dream household, score pre-approved for an easily affordable financial from the Allegiance. When you’re being unsure of regarding your book financial predicament, here are some our home loan hand calculators or contact our very own mortgage advantages today.

To improve your credit score, discuss our Credit Creator Financing, Credit Builder Charge card, and be sure to view our free economic classes possibilities.