Looking to loans household home improvements, a degree, otherwise debt consolidating? When you are a homeowner, the answer are right in front people!

The audience is talking about family equity, an effective equipment which will help home owners have the funds it must satisfy their lives and money requirements.

Home owners features several choices with regards to tapping into this new guarantee within their residential property, also home equity financing and money-aside refinancespared so you can unsecured loans, they are both relatively simple in order to qualify for and normally incorporate a lot more beneficial interest rates.

Basically, the essential difference between both boils down to the process: a home guarantee financing try separate from the financial, and you may a profit-away re-finance replaces your existing home loan with a brand new mortgage.

If you reside inside the Colorado, there are some a lot more nuances and regulations involved in family collateral and you may refinances-therefore let’s plunge for the!

House Security Financing

A property guarantee mortgage try that loan- separate out of your financial- that uses your home since equity. Domestic guarantee funds come in order to people with depending upwards equity in their possessions, because of the possibly making money on the home loan or through the admiration of your own property’s value.

Cash-Aside Refinance

Good loans in Orchard for people with bad credit re-finance concerns taking out fully another type of financing to repay an existing one to. Should you an earnings-out refinance, you borrow additional money than you owe on the newest mortgage and employ the excess dollars to cover other expenses.

According to housing marketplace, a money-away refinance can also give you accessibility ideal terms and conditions otherwise less rate of interest. Just remember that , when you have a national-supported loan instance a Virtual assistant, USDA, or FHA loan, you’ll most likely refinance so you can a conventional mortgage.

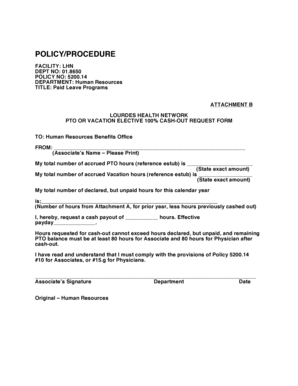

To give an idea of just how this type of financing evaluate side-by-side, we have separated a few of its key enjoys regarding the graph below.

Domestic Guarantee Financing and cash Out Refinance Guidelines when you look at the Texas

Colorado enjoys unique rules with respect to domestic security and you will borrowing-plus they would be state-of-the-art. I usually recommend speaking with a community a residential property financial when provided how these guidelines affect the money you owe.

step one. You should repay every next liens on the home prior to you can refinance.

For people who currently have a house guarantee financing or any other sorts of away from 2nd lien on the house you to was not paid, you are struggling to score a finances-out re-finance.

dos. You simply can’t remove property security mortgage shortly after a profit-out re-finance.

Colorado law states that in the event that you utilize their house’s collateral, you can’t do so once again up until you’ve paid the original mortgage. So if you do a finances-away re-finance, you simply can’t pull out a house collateral financing before home loan is repaid.

3. You could just take aside that security financing the one year.

Even if you pay off your first home guarantee loan or dollars-aside re-finance, you might still simply utilize your own collateral after per year. This is really important to keep in mind if you were to think you need a different loan a couple months later. If you think you will need more cash in the future, a property equity credit line is a very suitable option.

cuatro. Borrowers try not to have fun with more 80% of their home’s collateral.

Think about the way we said earlier your amount borrowed is bound from the amount of guarantee you’ve got? It is vital to observe that you could potentially never ever borrow on all the of your collateral you’ve got at home.

Tx law states one to individuals dont utilize over 80% of their residence’s security- even when the residence is possessed outright. Quite simply, 20% in your home guarantee should be 100 % free all the time.

So, eg, when you yourself have a property which is really worth $three hundred,000, and you’ve got 100% security at your home, the largest domestic guarantee mortgage that you may receive would be $240,000- causing you to be to your loan together with 20% guarantee in your home.

Determine Your position for the ideal Mortgage

Both dollars-away refinances and you will home guarantee finance might be high choices for experiencing the brand new equity of your house. Your best option to you depends upon individual activities and you will overall markets requirements.

- If you like a large amount of money to own a-one-go out bills, such as for example home home improvements otherwise medical bills, following a home collateral mortgage may be the best bet getting your.

- If you would benefit from an alternative financial on account of conditions otherwise a lower rate of interest, following a money-aside refi will be the better choice.

- There’s also an alternate options: a house equity credit line. If you find yourself hesitant otherwise won’t need to take-out an alternative financing, that is an effective provider to you personally and your cash.

Determining making use of your residence collateral are complicated, it need not be tough! Speaking with a neighborhood financial is a great way of getting a complete view of how you could possibly leverage your own residence’s equity.